Whitepaper

The residential real estate industry faces persistent challenges in lead conversion, with industry-wide averages remaining stubbornly low despite technological advances and sophisticated CRM systems. This comprehensive analysis of lead-to-closed-transaction conversion rates reveals significant variations across lead sources, team structures, and buyer versus seller segments, providing essential benchmarking data for agent performance optimization and go-to-market planning.

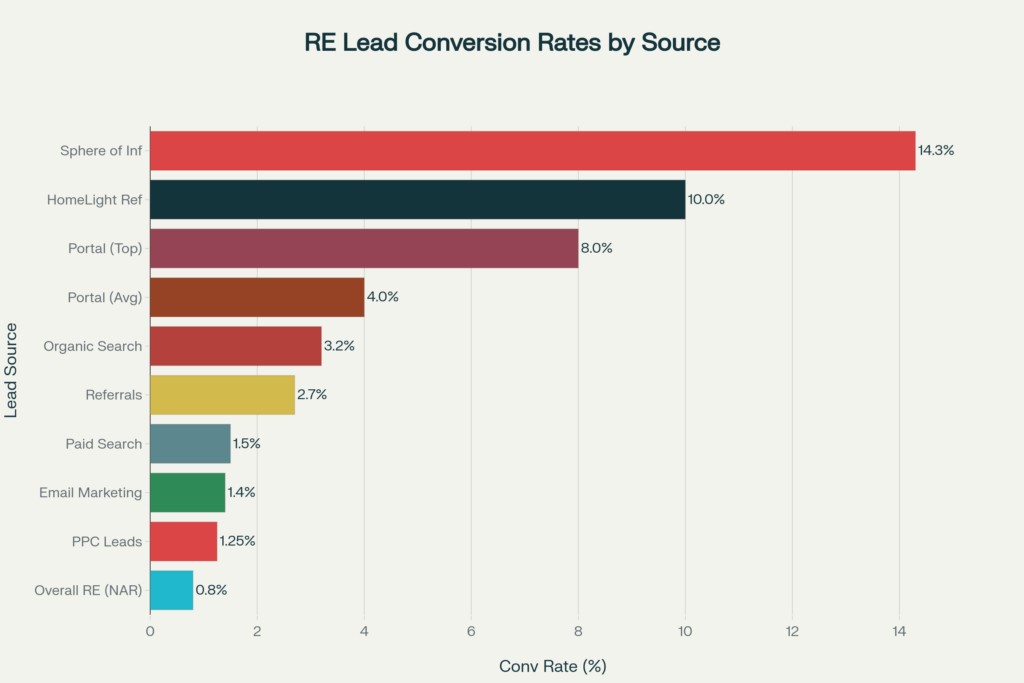

Real estate lead conversion rates vary significantly by source, with sphere of influence and HomeLight referrals achieving the highest conversion rates

Based on extensive analysis of industry data from the National Association of REALTORS®, leading CRM providers, and real estate technology companies, overall lead conversion rates in U.S. residential real estate remain between 0.4% and 1.2%, consistent with T3 Sixty’s assessment that industry conversion sits “sub one percent.” However, this broad average masks substantial performance variations across lead sources, with top-performing teams achieving 7-9% conversion rates on portal leads compared to just 1-1.5% for pay-per-click advertising leads.

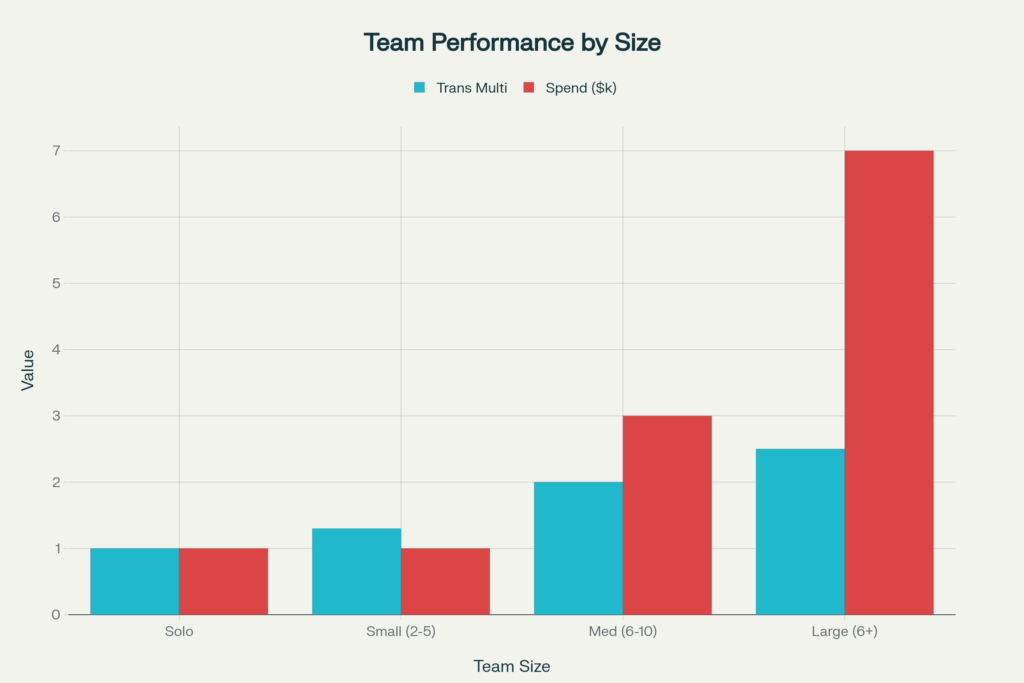

The data reveals a 2.5x performance advantage for real estate teams over solo agents, driven by specialization, higher marketing budgets, and systematic lead nurturing processes. Large teams with 6+ agents consistently outperform smaller operations, spending $2,500-$9,999 monthly on lead generation compared to under $1,000 for solo agents.

Digital advertising conversion rates vary significantly by platform and targeting strategy. Google Ads delivers the highest-intent leads with conversion rates averaging 3.2% for organic search and 1.5% for paid search, while Facebook advertising generates leads at lower costs but with 1-1.5% conversion rates. The real estate industry’s 8.43% click-through rate on Google Ads significantly outperforms the 6.66% average across all industries, yet converts at only 3.28%, indicating strong initial interest but challenging follow-up execution.

Website form submissions represent the lowest-converting digital channel at 0.6% conversion rates, emphasizing the critical importance of immediate follow-up and lead nurturing systems. Industry research consistently shows that leads contacted within five minutes are 100 times more likely to convert than those followed up after one hour.

Portal leads from Zillow and Realtor.com represent the highest-converting internet lead source, with top-performing teams achieving 7-9% conversion rates. However, average teams typically see 3-5% conversion on portal leads, reflecting the significant skill gap in lead handling and follow-up execution. HomeLight’s referral system, which pre-qualifies leads through human interaction, achieves approximately 10% conversion rates when agents follow best practices.

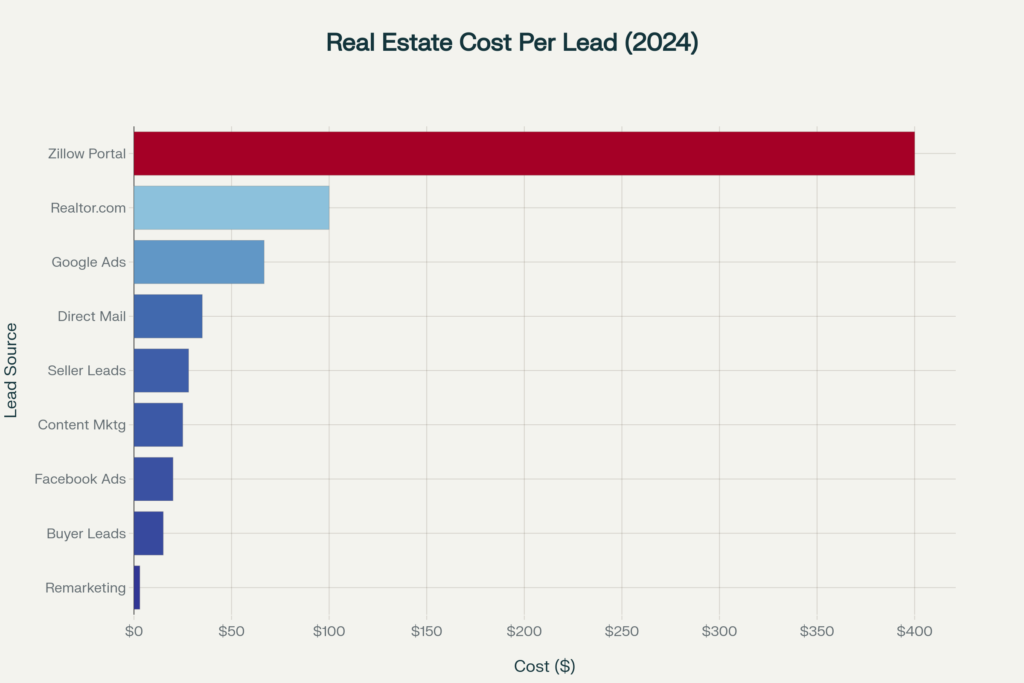

Cost considerations for portal leads are substantial, with Zillow charging up to $400 per lead in competitive markets and Realtor.com offering more moderate pricing around $100 per lead. Despite high costs, the superior conversion rates often justify the investment for teams with strong follow-up systems.

Print marketing continues to outperform digital channels in response rates, generating responses from 80% of consumers compared to 45% for digital ads. The trust factor plays a crucial role, with 82% of consumers trusting print advertisements when making purchasing decisions, compared to 61% for online ads. Direct mail specifically delivers a 29% return on investment and 161% ROI when sent to house lists, significantly outperforming email marketing’s 44% ROI.

However, print media effectiveness varies by market demographics and property types. Luxury markets and older demographic segments show stronger print responsiveness, while first-time buyer segments increasingly rely on digital channels.

Social media conversion rates separate distinctly between paid and organic strategies. Organic search converts at 3.2% on average, while paid social media advertising typically achieves 1-1.5% conversion. Facebook advertising for real estate shows average click-through rates of 1.59%, with 61.7% of organic search users converting via phone calls and 75.4% of paid ad clicks leading to phone conversions.

Social media’s primary value lies in long-term relationship building rather than immediate conversion. 19% of REALTORS® report getting 1-5% of their business from social media, with 10% getting 6-10% of their transactions from social platforms. The 18-24 month lead nurturing cycle required for social media leads demands sophisticated CRM systems and consistent engagement strategies.

Larger real estate teams achieve higher transaction rates per agent and invest more in lead generation than solo agents

Solo agents represent 74% of REALTORS® but face significant conversion challenges due to limited resources and time constraints. Solo agents typically spend $1,000 or less monthly on lead generation, constraining their ability to compete with team-based operations. The independence valued by solo practitioners comes at the cost of operational efficiency and lead conversion optimization.

Solo agent conversion rates cluster around the industry average of 0.4-1.2%, with top individual performers achieving higher rates through exceptional follow-up discipline and niche specialization. However, the time demands of lead generation, nurturing, and transaction management create natural scalability limitations.

Large teams demonstrate significant conversion advantages, achieving 2.5 times more transactions per agent than solo practitioners. These teams typically invest $2,500-$9,999 monthly in lead generation, enabling access to premium lead sources and comprehensive nurturing campaigns.

Operational specialization drives large team success, with dedicated roles for lead generation, nurturing, buyer specialists, and listing agents. This specialization, combined with higher marketing budgets, enables conversion rates of 7-9% on portal leads for top-performing large teams.

Buyer leads typically cost less to acquire but require longer nurturing cycles. Average buyer lead costs range from $9-20, significantly lower than seller lead acquisition costs. However, buyer leads often represent early-stage prospects with purchase timelines extending 12-18 months, requiring sustained nurturing investments.

Buyer lead conversion rates follow the broader industry patterns, with portal-sourced buyer leads converting at 3-9% depending on team capabilities. The volume of buyer leads available through digital channels provides scale opportunities, but the extended sales cycles challenge cash flow and resource allocation.

Geographic mobility affects buyer lead quality, with local buyers showing higher conversion rates than out-of-area prospects. 88% of buyers ultimately work with real estate agents, indicating strong market acceptance of professional representation.

Seller leads command premium pricing due to higher commission potential and shorter sales cycles. Seller lead costs average $26-30, reflecting both the higher stakes and increased competition among agents for listing opportunities. Seller lead conversion timelines typically compress to 3-6 months compared to 12-18 months for buyer leads.

Seller leads demonstrate higher urgency and decision-making authority, often requiring immediate response and professional presentation capabilities. 90% of sellers work with real estate agents, and 72% would definitely use the same agent again, indicating strong satisfaction and referral potential.

Market conditions significantly impact seller lead quality and conversion rates. Rising interest rates and inventory constraints in 2022-2024 reduced seller motivation, with many homeowners reluctant to give up favorable mortgage rates acquired during 2020-2022.

Real estate lead conversion rates have remained remarkably consistent over the past decade, with industry estimates consistently placing overall performance in the 0.4-1.2% range since at least 2015. This stability persists despite significant technological advances, CRM sophistication improvements, and marketing automation adoption.

T3 Sixty’s “sub one percent” assessment has remained consistent from 2019 through 2024, indicating that while lead generation volumes have increased dramatically, conversion efficiency has not improved proportionally. This suggests that lead quality dilution may be offsetting technological improvements.

The 2020-2022 market boom masked conversion rate challenges through increased transaction volumes and compressed sales cycles. Home sales peaked in 2021 before declining 23% through 2024, while new listings increased annually, creating inventory imbalances.

Days on market tripled from under 20 days in 2021 to almost 70 days in 2024, significantly impacting lead conversion timelines and agent productivity. This market shift has forced renewed focus on conversion optimization and lead quality improvement.

CRM adoption has accelerated significantly, with major platforms like HubSpot, BoomTown, and Follow Up Boss reporting substantial user growth. However, conversion rate improvements have not kept pace with technology investment, suggesting implementation and training gaps remain significant challenges.

AI-powered lead scoring and nurturing systems are beginning to show promise, with some platforms reporting 20%+ conversion rates through sophisticated targeting and personalization. These advanced systems remain expensive and require significant expertise to implement effectively.

| Lead Source | Buyer Conversion | Seller Conversion | Team Size Impact | Time Period |

|---|---|---|---|---|

| Portal Leads (Top Teams) | 7-9% | 7-9% | Large teams only | 2022-2025 |

| Portal Leads (Average) | 3-5% | 3-5% | All team sizes | 2022-2025 |

| Google Ads | 1.5% | 1.5% | Budget dependent | 2024-2025 |

| Facebook Ads | 1-1.5% | 1-1.5% | Budget dependent | 2024-2025 |

| Organic Search | 3.2% | 3.2% | SEO investment | 2024-2025 |

| Email Marketing | 1.4% | 1.4% | Database dependent | 2024-2025 |

| Direct Mail | 2-3% | 2-3% | Geographic focused | 2024-2025 |

| Sphere of Influence | 14.3% | 14.3% | Relationship dependent | Consistent |

| Referrals | 2.7% | 2.7% | Reputation based | Consistent |

| Team Size | Conversion Rate Range | Monthly Lead Budget | Transactions per Agent | Geographic Coverage |

|---|---|---|---|---|

| Solo (1) | 0.4-1.2% | <$1,000 | 10 sides/year | Local focused |

| Small (2-5) | 0.8-2.0% | $1,000-2,500 | 12-13 sides/year | Regional |

| Medium (6-10) | 1.5-4.0% | $2,500-5,000 | 15-20 sides/year | Multi-market |

| Large (10+) | 3.0-9.0% | $5,000-15,000 | 20-30 sides/year | Metro-wide |

| Marketing Channel | Cost Per Lead | Conversion Rate | Cost Per Transaction | ROI Timeframe |

|---|---|---|---|---|

| Zillow Portal | $400 | 3-9% | $4,400-$13,300 | 3-6 months |

| Realtor.com Portal | $100 | 3-9% | $1,100-$3,300 | 3-6 months |

| Google Ads | $67 | 1.5% | $4,467 | 6-12 months |

| Facebook Ads | $20 | 1.25% | $1,600 | 6-18 months |

| Direct Mail | $35 | 2.5% | $1,400 | 3-9 months |

| Content Marketing | $25 | 3.0% | $833 | 12-24 months |

| Remarketing | $3 | 5.0% | $60 | 1-3 months |

The 10x performance gap between top teams (7-9%) and industry average (0.4-1.2%) represents the most significant optimization opportunity in real estate lead conversion. This gap stems primarily from systematic follow-up processes, immediate response capabilities, and specialized role assignments within larger team structures.

Lead source diversification proves essential for sustained performance, with successful teams operating across multiple channels rather than relying on single sources. The highest-performing operations combine high-converting relationship-based sources (SOI, referrals) with scalable digital channels, achieving both quality and volume.

CRM adoption and lead nurturing automation directly correlate with conversion performance, yet many agents remain underutilized on available technology. The 18-24 month nurturing cycle required for optimal conversion demands systematic automation and consistent touchpoint management that exceeds most individual agent capabilities.

Speed-to-lead response remains critical, with five-minute response windows showing 100x higher conversion probability. This requirement favors team-based operations with dedicated lead management roles and sophisticated notification systems.

The shift toward team-based operations accelerates, with 85% of agents believing teams provide competitive advantages and 39% of agents planning brokerage changes in 2024 seeking better lead generation support. This trend suggests continued consolidation toward higher-performing team structures.

AI-powered lead scoring and nurturing systems beginning to show significant results, with early adopters achieving 20%+ conversion rates through advanced personalization. However, implementation costs and complexity currently limit adoption to larger, well-capitalized operations.

Market conditions will continue impacting conversion rates, with inventory normalization and interest rate stabilization expected to improve lead quality as buyer and seller motivations align more closely with traditional market patterns.

The data clearly demonstrates that while overall industry conversion rates remain low, significant opportunities exist for agents and teams willing to invest in systematic lead management, team specialization, and technology integration. Success increasingly depends on operational sophistication rather than individual sales skills alone, favoring structured team approaches over solo practitioner models.

Schedule your strategic consultation:

Empowering your business with data-driven strategies to unlock sustainable growth. Dive into our FAQs for a deeper understanding of how we tailor our solutions to meet, and exceed, your expectations.

Lead Elite Partners with you to achieve remarkable success through innovative solutions and insights.

Monday to Friday

07:00 – 16:00 Pacific Time

We collect and use your information to enhance our services, communicate updates, personalize your experience, and conduct research. We only gather Personally Identifiable Information (PII) when you provide it voluntarily, ensuring it’s used solely for account management, service provision, and legal compliance.

Your PII is never sold or rented; it may be shared with trusted partners under strict confidentiality. We prioritize your privacy with robust security measures and allow you to access, update, or delete your information at any time. PII is retained only as long as necessary for our services and legal obligations.